Discover the news shaping the future of carbon removal.

Stay up to date on all things Klimate, carbon removal, and the most important emerging news and policy. Read our latest Insights.

Understanding and navigating the reputation crisis in carbon offsetting

Understanding the reputation crisis in carbon offsetting

Carbon offsetting was supposed to be a straightforward climate solution: pay to cancel out your emissions elsewhere. Instead, it has become one of the most contested areas of corporate sustainability, with investigations revealing that many carbon projects deliver a fraction of their promised benefits or nothing at all.

The fallout has left companies facing greenwashing accusations, eroded public trust in carbon markets, and created genuine confusion about what actually works. This article breaks down why the reputation crisis happened, what distinguishes credible projects from questionable ones, and how carbon removal offers a more verifiable path forward.

Why carbon offsetting has a reputation problem

The reputation crisis in carbon offsetting comes down to a simple pattern: companies buy cheap, low-quality credits to claim environmental progress while delaying real emission cuts. Evidence suggests this isn’t an edge case but in fact, it’s been the dominant buying behaviour. One peer-reviewed study that built a company-level dataset of retired credits found that companies predominantly sourced “low-quality, cheap” credits, and that 87% of the credits assessed carried a high risk of not delivering real, additional emissions reductions, with most coming from forest conservation and renewable energy project types. (Nature)

That helps explain why nature-based projects, particularly forest protection schemes, keep becoming flashpoints. Who doesn’t remember the Kariba REDD+ project in Zimbabwe, where reporting documented allegations that climate benefits were overstated and that the project became a major revenue generator for intermediaries, which in return raised hard questions about the credibility of credits used by large brands to support climate claims. (The New Yorker) The result is a market where greenwashing accusations have become widespread, and offsets are increasingly seen as a “get-out-of-jail-free card” rather than a genuine climate solution. After learning what I do for a living, someone recently gave me the now fairly common: “I feel like that’s not working anyway”.

So how did we get here? Why do most people believe the world of carbon offsetting is one big scam? Part of the problem is a knowledge gap. Many buyers lack the expertise to tell the difference between a high-quality project and one that exists mostly on paper. When a company purchases carbon credits, they're often trusting that someone else has done the due diligence. That trust has been broken repeatedly especially when scandals emerge around exactly the kinds of low-cost credits that have historically been easiest to buy at scale. (Nature)

The fallout extends beyond environmental concerns. Companies that invested in what they believed were legitimate climate solutions now face accusations of greenwashing, regulatory scrutiny, and damage to their public image. Offsetting is ultimately a strategy, accompanied by a claim, now associated with low quality credits — smoke-and-mirrors lacking robust evidence. Meanwhile, projects that actually deliver real impact struggle to attract funding as scepticism spreads across the entire market because every new controversy makes the “offset” label itself harder to defend, regardless of quality. (SWI swissinfo.ch)

What is greenwashing in carbon offsetting

Greenwashing… A term we’ve all gotten used to as part of the reputation problem. Greenwashing happens when organisations make misleading environmental claims to appear more sustainable than they actually are. In carbon markets, greenwashing typically involves purchasing cheap credits to claim "carbon neutrality" without making meaningful efforts to cut emissions at the source.

The practice shows up in several ways:

- Misleading claims: Companies overstate the impact of their purchases, suggesting they have "neutralised" their carbon footprint when the underlying credits may have little or no environmental return. The claimed impact of the offset is therefore unequal to the impact of emissions.

- Lack of verification: Buying credits without independent quality assessment or proper due diligence on whether projects actually deliver what they promise. Without providing proper evidence to back a claim, they fall fall short.

- Avoidance over action: Using inexpensive credit as a substitute for the harder work of reducing emissions directly.

When consumers and investors discover that environmental claims lack substance, trust erodes not just in the offending company, but in corporate sustainability efforts more broadly. This is why greenwashing accusations have become such a significant reputational risk.

Key risks that undermine carbon market credibility

Now, it’s important to underline that the risk of greenwashing is there for a reason. Some credits are of a poor quality and there’s a number of technical problems that cause projects to fail. Understanding each one helps explain why so many credits have proven worthless and what to look for when evaluating project quality.

Additionality failures

Additionality means a project would not have happened without carbon finance. If a forest was already protected by law, or a renewable energy plant was already profitable without carbon revenue, then selling credits for that activity generates no additional climate benefit.

The challenge is proving a counterfactual—what would have happened without the project. This is inherently difficult to demonstrate, and many projects have been found to claim credit for activities that would have occurred anyway.

Permanence concerns

Permanence refers to how long carbon stays stored. A tree absorbs carbon dioxide as it grows, but if that tree burns in a wildfire or gets cut down, the stored carbon returns to the atmosphere.

This risk is particularly acute for some nature-based projects. Climate change itself increases the likelihood of fires, droughts, and pest outbreaks that can destroy carbon stores decades before their intended lifespan ends.

Leakage and displacement

Leakage occurs when emissions shift elsewhere rather than being prevented. For example, protecting one forest may simply push logging activity to a neighbouring area that lacks protection.

This displacement effect can negate much or all of a project's claimed benefit. Accounting for leakage requires monitoring beyond project boundaries—something many schemes fail to do adequately.

Baseline inflation

The baseline is the reference scenario used to calculate avoided emissions. If a project claims it prevented deforestation, the baseline represents how much forest would have been lost without intervention.

Inflated baselines lead to credits being issued for reductions that never actually occurred. Some projects have been found to exaggerate deforestation threats dramatically, generating millions of credits for "avoided" emissions that were never going to happen in the first place.

How to identify high-quality carbon projects

Ready to write-off carbon credits as a whole? Don’t worry, there is hope for the market’s reputation as not all carbon projects are created equal. Several criteria help distinguish credible initiatives from questionable ones.

1. Verify third-party certification

Reputable standards like Verra, Gold Standard, and Puro.earth provide independent verification of project claims. However, certification alone is not sufficient and even certified projects have been found to underperform. Look for projects that go beyond minimum certification requirements and provide detailed, transparent documentation.

2. Assess additionality evidence

Strong projects provide clear documentation showing that carbon revenue was essential to their viability. If a project would have happened anyway—through existing regulations, economic incentives, or other funding sources—the credits it generates have limited value.

3. Evaluate permanence guarantees

Check how long carbon will remain stored and what safeguards exist if storage fails. Some standards require buffer pools or insurance mechanisms to address reversal risks, providing an extra layer of protection.

4. Demand transparent monitoring data

Quality projects provide ongoing measurement, reporting, and verification (MRV). This includes regular updates on project performance, independent audits, and publicly accessible data that allows buyers to track outcomes over time.

The lack of transparent data is a root cause of the reputation crisis. When buyers cannot independently verify project outcomes, they rely on trust—trust that has been repeatedly violated by projects that overpromised and underdelivered.

Quality projects openly share their methodology and assumptions, independent verification reports, ongoing monitoring data, and clear impact metrics. This transparency allows buyers to make informed decisions rather than taking claims at face value.

Technology is improving verification capabilities. Satellite monitoring can track forest cover changes in near real-time. Sensor networks can measure soil carbon with increasing accuracy. Digital registries can provide tamper-proof records of credit issuance and retirement. Together, these advances make it harder for low-quality projects to hide behind opaque reporting.

5. Prioritise carbon removal over avoidance

Removal projects offer more certain, measurable outcomes than avoidance-based credits. While removal credits typically cost more, they carry lower risk of the additionality and permanence problems that have damaged the offset market's reputation.

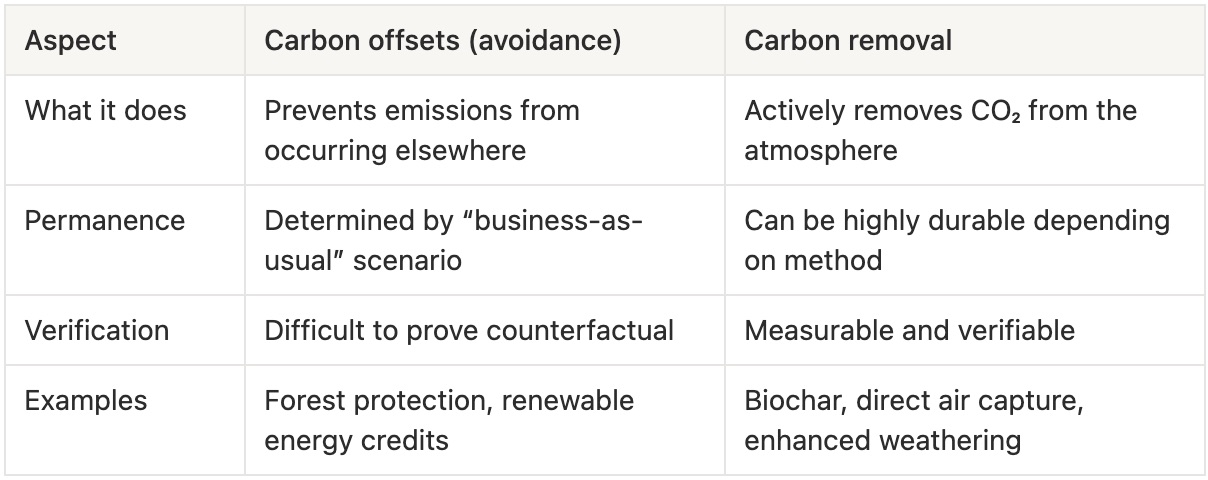

Carbon offsets vs carbon removal

Call me biased, but I want to dive a bit further into the world of carbon removal and how it can deal with the reputation crisis. Understanding the distinction between avoiding emissions and removing carbon is essential for navigating this difficult landscape. The two approaches work differently and carry different risks.

How carbon offsets work

Traditional carbon offsetting involves companies that pay for cheap activities that prevent emissions from occurring to balance-out their own emissions, called avoidance. Protecting a forest prevents the carbon stored in trees from being released. Funding a clean cookstove project prevents emissions from traditional cooking methods.

The challenge lies in proving that the emissions would have occurred without the intervention. This is the additionality problem—and it is why avoidance-based offsets are so difficult to verify with confidence.

How carbon removal works

Carbon Dioxide Removal (CDR) takes a fundamentally different approach. Rather than preventing future emissions, CDR actively extracts CO₂ already present in the atmosphere and stores it for decades to centuries. This addresses the present impacts of climate change and prevents amplified warming due to avoidance creating reductions down the line.

Why permanence matters for climate impact

To truly offset one tonne of carbon, the carbon should be stored for the same amount of time as the emissions released. Durable carbon storage, where carbon is kept our of the atmosphere for centuries or longer, is essential to ensuring long-term climate benefit.

This is why permanence has become a central criterion for evaluating carbon credit quality for companies that plan to offset, and why many organisations are shifting their focus toward removal methods with longer storage timescales.

How companies can avoid carbon credit greenwashing

For organisations seeking to invest in carbon projects responsibly, several principles help reduce risk and build credibility.

1. Prioritise emission reductions first

Carbon credits work best as a complement to direct decarbonisation efforts, not a substitute. Emerging regulations and voluntary frameworks increasingly require companies to demonstrate internal emission reductions before claiming offset benefits. This "reduce first, then offset" approach aligns with scientific guidance on effective climate action.

2. Choose verified carbon removal projects

Investing in CDR rather than avoidance offsets reduces reputational risk and delivers more certain impact. While removal credits typically cost more per tonne, they provide stronger evidence of genuine climate benefit and face fewer of the verification challenges that have plagued traditional offsets.

3. Use independent project assessment

Working with platforms that conduct rigorous scientific evaluation of projects helps identify quality opportunities. Look for partners who assess projects against multiple criteria—not just certification status, but also additionality evidence, permanence guarantees, and ongoing monitoring practices.

4. Communicate climate claims accurately

Avoid over-claiming. Be specific about what offsets achieve versus what internal reductions achieve. Transparency about methodology and limitations builds credibility rather than undermining it. Companies that communicate honestly about their climate strategy—including its limitations—tend to fare better when scrutiny increases.

How science-backed carbon removal rebuilds market trust

The reputation crisis, while damaging, has also driven positive change. Rigorous scientific evaluation, transparent data, and measurable outcomes are becoming the new standard for credible climate action.

High-quality CDR projects demonstrate that carbon markets can deliver genuine impact when built on solid foundations. By focusing on verifiable removal rather than uncertain avoidance, these initiatives offer a path forward for organisations committed to meaningful climate action.

For organisations exploring credible carbon removal options, get in touch to learn about high-integrity solutions backed by rigorous scientific assessment.

Making the investment case for carbon removal: Strategies that work

Why carbon removal investment is a strategic priority

Corporate sustainability has entered a more challenging era. Where sustainability used to be about bold targets and high-level goals, 2026 is shaping up to be a year focused on practical results, risk management and integration with core business priorities. Many companies are already adjusting how they talk about sustainability. As Solitaire Townsend recently noted, the conversation is shifting away from idealistic narratives and towards language rooted in resilience, risk, and long-term value.

Instead of positioning carbon removal as a discretionary climate project, it seems more and more sustainability teams are reframing it as a core element of risk management and future-proofing. For many of us, this shift can feel counterproductive as it moves the conversation away from climate ambition and towards business risk. But the action itself remains just as meaningful — and that is an important point to hold on to.

There is also a clear upside. This framing makes it easier for finance and leadership teams to see carbon removal as a long-term business priority, rather than a peripheral cost. In doing so, it helps sustainability teams make a stronger, more credible investment case.

In this environment, carbon removal is not just another climate initiative. It is a strategic tool that connects sustainability goals with business reality.

What makes carbon removal budgeting challenging

Even when the strategic case is clear, securing budget for carbon removal is still often difficult. Sustainability teams face real, practical barriers when they bring CDR proposals to finance and leadership teams.

- Volatile carbon credit pricing: Carbon credit prices can change significantly over time, making long-term budget forecasting difficult. Many markets operate on spot prices, meaning prices available today may not reflect future costs.

- Difficulty quantifying climate ROI: Carbon removal does not generate a traditional financial return. Its value shows up in reduced risk, stronger credibility, and future readiness, which are harder to translate into standard return on investment (ROI) metrics.

- Competing internal budget priorities: Sustainability teams are often competing with growth, technology, and operational projects for limited funds. Carbon removal can feel abstract to teams focused on short-term financial performance.

- Knowledge gaps among decision-makers: Many executives still do not clearly distinguish between emissions reductions, offsets, and removals. Without this understanding, it is difficult to justify why quality and durability matter, or why carbon removal commands a higher price.

How to build a compelling investment case for carbon removal

This is where framing really matters. A strong internal investment case for carbon removal is less about climate ideals and more about business relevance. As with any communication, the starting point is the audience in front of you and what resonates with them.

1. Frame carbon removal as risk mitigation

Position carbon removal as a way to manage risk. This includes regulatory risk, reputational risk, and long-term financial exposure. Investing in high-quality CDR reduces the chance of future compliance costs, public criticism, or being locked into low-quality solutions that do not stand up to scrutiny. Addressing the fear of greenwashing also matters significantly to leadership. Sharpening data and having transparent progresses around investments are means to avoid greenwashing.

2. Quantify the cost of inaction

Doing nothing also has a cost. Volatile carbon prices, stricter regulations, and loss of stakeholder trust can all carry financial consequences. Comparing the cost of carbon removal today with potential future penalties or lost opportunities helps shift the conversation.

3. Connect investment to regulatory readiness

Disclosure frameworks and climate reporting requirements are evolving quickly and we’ve seen lots of updates in just recent monts to standards like SBTi and CSRD. Early investment in carbon removal helps organisations build systems, data, and processes that will be needed as expectations tighten. This reduces last-minute compliance risk.

4. Benchmark against industry peers

Showing what peers or industry leaders are doing creates urgency. Carbon removal is increasingly part of credible climate strategies across sectors. Falling behind peers can carry reputational and commercial risks.

5. Translate climate impact into business language

Internal conversations land better when they focus on risk exposure, brand value, and stakeholder confidence rather than tonnes of CO₂ alone. Climate outcomes matter, but business language helps decision-makers connect the dots.

Climate language vs business language

Climate language: “We need to neutralise residual emissions.”

Business language: “We need to reduce long-term regulatory and reputational risk.”

Climate language: “This project removes carbon permanently."

Business language: “This investment reduces exposure to future climate liabilities.”

Budget strategies that work for carbon removal procurement

Once approval is secured, the next challenge is structuring the budget in a way that works over time.

Scenario-based budget planning

This approach models different future scenarios, such as low, medium, and high carbon price pathways. It helps teams prepare for volatility and shows leadership that uncertainty has been considered, not ignored.

Multi-year commitment structures

Multi-year agreements can provide price stability and supply certainty. They also demonstrate long-term commitment, which strengthens credibility with stakeholders and project developers alike.

At Klimate, lots of our customers take this approach that shows a commitment to combat climate change but also shows strategic business thinking. One example is Jubel, a UK-based beer brand, that wanted to secure preferential pricing among other goals. A three-year carbon removal strategy gave them that exact solution.

Timing procurement right with the help of a partner

Early commitments can secure better pricing and access to supply, while waiting can preserve flexibility. Each approach has trade-offs. The right balance depends on risk tolerance, budget cycles, and climate targets. Another pathway is to join forces with a partner that takes care of procurement for you and has negotiated the best prices on your behalf.

Why a portfolio approach strengthens your investment case

A portfolio approach means investing across multiple carbon removal methods rather than relying on a single solution. This mirrors how financial portfolios manage risk.

Balancing cost and permanence

Some methods, such as nature-based solutions, tend to be lower cost but store carbon for shorter periods. Engineered solutions are typically more expensive but offer longer-lasting storage. A mix allows teams to balance affordability and durability.

Spreading risk across removal methods

Relying on one method increases exposure if that approach underperforms or faces supply constraints. Diversification reduces this risk and aligns with emerging best practice.

Aligning solutions with corporate values

Different removal methods come with different co-benefits. Some support biodiversity and local livelihoods, while others showcase technological innovation. A portfolio can reflect what matters most to your organisation and stakeholders.

How to ensure quality in carbon removal investments

Quality is central to any credible investment case. Without it, carbon removal risks becoming a cost without value.

- Permanence and durability: Permanence refers to how long removed carbon stays stored. Longer storage periods reduce the risk that carbon returns to the atmosphere and strengthen climate claims.

- Additionality and real impact: Additionality asks whether the removal would have happened without your investment. High-quality projects depend on carbon finance to exist and deliver real impact.

- Transparent monitoring and verification: Robust Monitoring, Reporting, and Verification (MRV) systems and independent verification build confidence in reported outcomes.

- Co-benefits beyond carbon: Environmental and social co-benefits, such as biodiversity gains or community income, add value and strengthen internal and external support.

Making carbon removal part of how the business operates

Securing budget once is hard. Securing it year after year is harder. The teams that manage it tend to focus less on perfect arguments and more on trust, consistency, and internal relationships. They take time to build executive support, not by overwhelming leaders with detail, but by helping them understand why carbon removal matters in the first place. They report progress clearly and regularly, using simple signals that link back to business priorities rather than treating carbon removal as a standalone climate initiative.

Over time, carbon removal stops being a special request and starts showing up in planning cycles, targets, and internal KPIs. In my experience, that shift is often what turns one-off approvals into something more durable.

Having the right partners can also make a difference. When procurement, reporting, and quality assurance are handled transparently, it reduces internal friction and gives finance and leadership teams confidence that the investment is well managed.

Turning commitment into something the business recognises as value

A strong investment case for carbon removal is less about making the perfect climate argument and more about showing how the decision holds up in the real world. It combines clear thinking on risk, confidence in quality, and a practical approach to budgeting that acknowledges uncertainty rather than ignoring it. It also recognises the wider context companies are operating in — changing regulation, tighter scrutiny, and an increasingly complex global environment. Climate action does not sit outside these pressures. It is shaped by them.

If we strip it back, the question of how sustainability teams can ensure budgets for carbon removal and how to make the investment case in-house often comes down to one thing: learning when to speak the language of climate ambition, and when to speak the language of the business.

Wrapping up COP30: Key takeaways and what’s next for global climate action

Fossil fuel phase-out – or not?

As negotiations continue into the weekend, delegates are working toward a resolution on major issues: funding for adaptation, accountability on climate finance, and addressing the root causes of the climate crisis—fossil fuels and deforestation. These must be handled in a just manner that doesn’t exacerbate debt.

Right now, a roadmap to phase down fossil fuels appears to be off the table, as it’s been left out of the updated leaked text. For many large fossil producers and consumers, any mention of a phaseout is a dealbreaker. However, for at least 29 countries, this issue may be non-negotiable.

Earlier this week, I wrote: if delegates aren't willing to consider eventual decarbonisation, what’s the point? Fossil fuels are undeniably one of the primary causes of rising CO2 emissions, and there is no quick fix for total decarbonisation (something I’ve learned over nearly three years in the carbon removal field).

Up next: Ministers agree on a final resolution

The agenda at COP30 has shifted as negotiations have advanced in some areas and stalled in others. The main objective for delegates remains to agree (and compromise) on a resolution for next year’s climate action. There were many issues on the table this year, with notable participation from civil society, but has COP30 lived up to being the ‘implementation COP’? I’m not so sure.

Here were the four interconnected issues outlined at the start:

- Financial Aid: Delivering $300 billion per year in climate finance

- Climate Plan Ambition: Whether countries should strengthen their climate commitments

- Trade Barriers: Addressing climate-related trade restrictions

- Transparency: Improving reporting on climate progress

The Belém presidency has been pushing a science-aligned and people-centred agenda. Well put by Marcio Astrini, this presidency has worked hard to shape negotiations on “fossils, forests, finance: three core areas of climate change, delivered under a framework based on justice and poverty alleviation.”

Carbon markets & Article 6 are still on the table

Alongside mitigation ambition and cooperation between countries, discussions around Article 6 of the Paris Agreement continue.

What is Article 6? It’s a framework for countries to cooperate voluntarily to achieve their Nationally Determined Contributions (NDCs) and increase climate ambition (described really well in this post). The next rules of play are being outlined, including how countries and even the private sector can contribute to mitigation outcomes.

For carbon markets, this could mean a new way of operating with a direct link between high-integrity credits and Paris Agreement goals. However, the key issue remains integrity—governance, transparency, and permanence are still being worked out. Follow Simon Pfluger for updates there.

Outside of Article 6, carbon dioxide removal (CDR) is an important element of national climate roadmaps, adaptation measures, and even just transition, if implemented intentionally. This was a historic stage for carbon removal in particular, in part thanks to efforts from CDR30: The Global CDR Initiative at COP30. They brought awesome insights on CDR in practice, the role of governments in spurring demand, and the synergy of CDR and other major thematic items, from justice to finance to private sector.

If we move forward with a UN 'Paris-aligned' market, the need for rigorous, independent due diligence on all crediting mechanisms has never been clearer. Without it, we risk eroding the trust in carbon markets as a whole.

Maybe not the COP we wanted, but it's the COP we got

Regardless of where negotiations end up by Sunday, COP isn’t the only climate conference. There are already upcoming G7 and G20 meetings, where President Lula has promised to bring the fossil-fuel phaseout debate to the table.

What can we actually expect from COP? On the one hand, we can and should ask for more from representative governments especially as public concern over climate change is at an all time high. Ultimately, COP is an exercise in global environmental governance, but it’s not, and realistically never will be, the primary stage for climate progress.

The Role of the VCM in Scaling CDR: Trends and Opportunities

What is the Current State of the VCM?

The VCM has grown significantly over the past decade, with buyers increasingly shifting from avoidance to removal credits. CDR purchases are trending up—Q2 2025 saw more tonnes contracted (15.48 million) than all prior quarters combined (13.6 million). Companies setting voluntary net zero targets, which require some CDR to achieve targets, nearly tripled (from 417 to 1,245) in the last year, demonstrating sustained ambition despite talk of a "net-zero recession".

The IPCC estimates 6 to 16 gigatonnes of removals are needed annually by mid-century; the market today delivers only a fraction of that. Scaling to this level would potentially create a $7-35 billion industry by 2030, a 3-15x multiple in the next 5 years, and a $1.2 trillion industry by 2050.

Despite significant growth, the reality drawn from the recent body of research is:

- Most companies have not set net-zero targets (although many have)

- There are growing concerns that companies with net zero targets are not on track to meet both near- and long-term targets

- Delivery of scope three targets is particularly challenging.

Barriers remain to widespread company buy-in. High prices, limited expertise, and a lack of standardised methodologies for assessing credit quality hinder widespread adoption of high-quality removal credits.

Buyer motivations and purchasing trends

Corporate participation in VCM is driven by various factors, primarily 1) making progress towards internal or externally committed climate goals or 2) demonstrating action across broader social and nature goals, linked to stakeholder pressure and brand value. These factors shape credit selection, pricing, and prioritisation of methods, but can also constrain how and when companies use carbon credits.

Most voluntary frameworks confine the use case of carbon credits to two areas: compensating for residual emissions (10%) with permanent removals, or beyond the value chain (BVCM) in the form of contributions that occur outside emissions accounting books. Neutralising residual emissions is likely to yield only 0.1-1.3 GtCO2e per year, yet it is the only case mandated by standards. BVCM could unlock millions in climate finance, but lacks the leverage to be a priority for many companies. While this doesn't reflect the entire picture of the VCM, without clear and significant incentives, current buyer behaviour is likely to be insufficient to scale CDR to be ready for future net zero.

Today’s corporate frameworks for net zero require two things: deep emission cuts (60-90%) and compensating residual emissions with CDR. However, no framework requires that companies scale the CDR sector in the near-term to meet 2050 needs, though SBTi is considering near-term scope 1 removal targets and has proposed a 'gold star' program for BVCM participants.

While frameworks recognise CDR as essential to net-zero, none incentivise building the sector now. This gap limits corporate climate finance and puts all target-setters at risk of missing their stated goal: limiting warming to 1.5-2°C.

Strategic opportunity: How the VCM can play a larger role in scaling CDR

The VCM is already playing a critical role in creating early demand for CDR. But, without near-term development of the market, net-zero progress is stalled. This is true for a broad spectrum of decarbonisation technologies and infrastructure beyond CDR. As mitigation outcomes stall, corporate climate leaders–and the standards that guide their actions–must incentivise scaling CDR in the near-term or risk missing net zero targets on a global and individual scale.

Further strategic buying behaviours can drive economies of scale and make CDR more affordable. This type of action not only scales CDR but actually helps companies meet interim climate targets, ensures companies stay on track while working to reduce their own emissions, and decarbonises in a cost-effective way in the long-run.

We’ll dive into these strategic CDR use-cases below, all of which have potential to create meaningful net-zero progress in the coming years 5, 10, or 15 years before residual emission compensation at 2050.

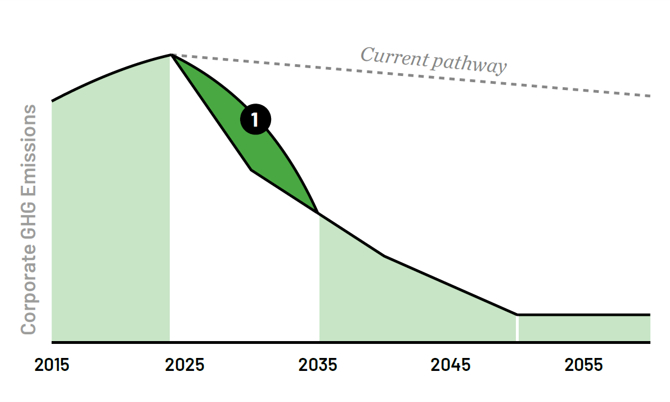

1. Closing the gap

Rather than and end-stage activity, CDR offers unique opportunities for companies to close the emissions gap between their internal reduction efforts and the necessary emissions removals. Many buyers have yet to fully leverage credits to fill near-term shortfalls in their decarbonisation path. Instead of considering CDR as a ‘maintenance’ activity at net zero, companies can create real decarbonisation progress, presenting strategic opportunity for participation in the VCM.

Using CDR to catch-up to commitments or statutory net zero targets would unlock massive financial potential for the market, and generate up to 5.9 GtCO2e of removals per year. More than unlocking finance, this effort would provide crucial, timely, climate mitigation to account for how internal decarbonisation has fallen short, noted in the significant gap between the dotted line and black line at the bottom of block 1.

2. Set & hit interim removal targets

Setting interim reduction and removal targets is a pragmatic approach to getting back on track to net-zero commitments. As noted above, an overly cautious approach to the sequence of reductions and then removals can result in stagnant years where no action happens at all. Setting, achieving, and clearly communicating interim targets every 5-10 years highlights ambition and accelerates global decarbonisation.

For example, let’s look at Company A’s journey to a 2050 net-zero target. Beginning in 2025, they measure a baseline of 100,000 tonnes CO2e annual emissions. A 2030 interim target could reduce emissions to 70,000 tonnes (a 30% reduction) and remove 5,000 tonnes through CDR credits. By 2035, they reduce emissions by 50% and remove 10,000 tonnes. This continues until 2050, when their reduction target equals their removal target—allowing them to neutralise remaining emissions with permanent removals. Setting these 5–10 year checkpoints keeps the company accountable, demonstrates continuous progress, and scales CDR purchasing gradually, giving the company experience with budgeting for carbon and effectively pricing their emissions.

3. Addressing ongoing emissions

A significant opportunity lies in addressing unabated emissions from sectors that continue to produce high carbon outputs despite best efforts at decarbonisation. For example, industries such as professional services, technology, and manufacturing are seeing large volumes of emissions in their Scope 3 categories. Taking responsibility for these is currently termed BVCM, or climate contribution, occurring outside emissions accounting.

Companies can address ongoing emissions by investing in contribution or removal credits that align with the yearly emission outputs–either with a 1 to 1 ratio, or a so-called money-for-tonne approach that covers a significant amount of a given company’s total tonnes while also directing finance into most critical areas. If companies quickly get back on track with their intended reductions, this lowers the cost of taking responsibility.

Depending on how quickly companies get back on track with their reduction targets, using credits to address ongoing emissions could unlock 0.27 to 3.2 GtCO2e of additional mitigation. But if corporate emissions reductions continue to lag, this figure could be much more. By deploying removal credits strategically in these sectors, companies can smooth the transition to net-zero while maintaining progress on their climate commitments.

4. Decarbonise within the value chain

Insetting is regarded as interventions within the value chain that result in a removal or permanent reduction. Methodologies and accounting for insetting programs are in development and vary across sector. However, this path offers an obvious win-win for decarbonisation and removal sector financing. Value chain removals could take the form of a grocery story investing in regenerative agriculture credits at one of their produce farms, or a construction company investing in and using mineralised concrete in a new build. By investing in credits or technologies that remove or permanently reduce the emissions of their own value chain, they can reduce their operational emissions, getting one step closer to net zero.

Tools, guardrails, and regulations

Beyond specific purchasing strategies, new procurement pathways are necessary to scale the VCM and make credits more accessible. Some examples include pooling smaller buyer demand, which can generate the volume needed to bring costs down, and bundling portfolios of credits to mitigate costs across different types of removals. Blended finance and other hybrid public-private mechanisms can reduce risks for emerging removal technologies. These tools improve affordability, enable portfolio diversification, and broaden market impact.

Linking voluntary credits to compliance systems, such as regulatory carve-outs for specific credit types, could make the market more liquid. Dual incentives for compliance and voluntary targets would amplify the VCM's role in global emissions reductions. Through a strengthened regulatory environment, standardised national approaches, and improved infrastructure, we build confidence in the market and remove barriers to exponential growth.

Ensuring a stronger role for the VCM in the future

The Voluntary Carbon Market is uniquely positioned to drive the scaling of CDR in the coming years. The voluntary market can catalyse removal scale not only by providing financial support, but also by deploying more sophisticated procurement tools, price signals, and buyer behaviours that strengthen market dynamics and reduce risk. If we wait for mandatory frameworks alone (e.g., compliance markets), we risk both missing key scaling opportunities for CDR and climate mitigation outcomes. This creates an interesting relationship: the VCM is important to help decarbonising technologies scale, but also these technologies in turn help VCM actors achieve cost-effective net zero.

.jpg)

Building carbon removal portfolios and managing risk

Portfolios have been central to Klimate's advisory services from the beginning. In line with our mission to support the scaling and development of carbon removal projects and technologies, portfolios offer key benefits: They diversify impact, manage risk, and tailor investments to meet organisational goals. In a relatively young industry like CDR, new projects and technologies emerge constantly. So, it makes sense that climate leaders would "travel every road possible" to support climate solutions in our fight against climate change.

How does a CDR portfolio benefit your company's climate goals?

When approaching CDR investment, portfolios attract buyers for several reasons. Instead of picking one project, where buyers often need to sign long-term and large-scale agreements, portfolios offer a more flexible approach. Companies interested in CDR investment can also maximise impact, tailor their spending to meet specific goals, and balance risk. Ultimately, portfolios ensure that companies actually achieve their intended climate goals. Here's how:

1. Maximise and diversify impact

Most investment portfolios encourage diversification. In the case of CDR portfolios, diversification enables buyers to maximise their investment and provides a crucial balance between technologies and credit delivery timelines.

Carbon removal methods vary significantly in price, from €30 to €1,000 per tonne. And, ex-post credits, representing a tonne of already-removed carbon, are typically more costly than future deliveries from the same method or project. In terms of risk, some nascent technologies or up-and-coming projects—although essential to support—may not be a good fit for companies prioritising the certainty of delivery. This balancing act enables buyers to access projects they wouldn't otherwise be able to invest in, so that budget doesn't limit ambition.

2. Align with your organisation

Investing via a portfolio allows companies to make specific, tailored choices, regardless of their company size or budget. Deciding your own priorities and investing accordingly is a great way to boost the resonance of a CDR strategy in your organisation.

Some priorities may include how durably carbon is stored, catalysing nascent tech, or boosting specific co-benefits such as biodiversity. Companies can also consider the other vital areas beyond just 'carbon' to decide what makes a project 'good'.

Furthermore, some projects or locations may align perfectly with a company's story or industry. For example, Real Estate Company A is drawn to credits from a carbon mineralisation project where the carbon is actually injected into cement. Company A can support the development of an early-stage project that may benefit the carbon management of their industry in the long run, and at the same time, engage with nature-based solutions that contribute to biodiversity, another key metric of their ESG agenda. This choice balances cost, certainty, and impact.

3. Effectively manage risk and balance trade-offs

The CDR space is full of proven, scalable solutions and in this early stage of developing carbon markets, no single solution has emerged as the 'winner'. As new approaches and projects continue to emerge, there can be risks ranging from technological delays to failure to secure the necessary finance for business operations. The portfolio approach mitigates this risk, as it's easier to replace a portion of the investment, as opposed to the entire investment.

Additionally, all projects have strengths and weaknesses. A rigorous due diligence process is an essential step to gain awareness of both delivery risk and a given project’s trade-offs. Balancing a given solution’s trade-offs through a diverse portfolio further secures the positive impacts your investment can have.

The numerous impactful projects that exist are indeed worth supporting in their early stages, and they are all a part of the climate toolkit necessary for achieving net zero.

Portfolios designed to best-fit client needs

Part of CDR strategy 101 is understanding what motivates the purchase, so you can align a procurement pathway that looks and feels like your organisation. These questions can help determine the composition of the portfolio and where the decision-making process will go:

- Are you looking for a specific number of tonnes or need a particular delivery timeline to meet your net zero commitments?

- Are you interested in specific impacts (permanence, co-benefits like biodiversity, jobs), locations, or SDGs?

- To what degree would you like to support nascent technologies versus established NBS/hybrids?

Any given strategy can and should evolve. As buyers become more knowledgeable or find their organisational goals shift with changing goalposts, portfolio distributions can easily adjust along with them. By starting with and well-balanced portfolio, companies can effectively price their residual carbon emissions and prepare for a net-zero future.

How portfolios help meet climate goals and create a functioning, mature CDR market

By developing a global marketplace that balances established projects and emerging technologies, we can scale important climate pathways and build the necessary market infrastructure. In the end, the climate doesn’t care where in the world a tonne of carbon is removed. Exploring and supporting diverse locations opens up the possibility of creating greater impacts. Looking beyond carbon helps address the multiple interconnected environmental crises, while the portfolio approach lowers barriers to entry, ultimately contributing to creating the robust market we need to achieve net zero goals. Supporting a diverse portfolio of projects with balanced costs and co-benefits across the globe is the most effective way to reach our shared climate goals.

Scaling carbon dioxide removal now to meet future net-zero targets

The 2030 and 2050 milestones outlined by the Intergovernmental Panel on Climate Change (IPCC) are fast approaching: a 45% emissions reduction by 2030 and net zero by 2050. Today, almost no country is on track to meet them. To stay within 1.5°C warming and avoid the most severe impacts of climate change, we must accelerate emissions reductions and the deployment of CDR. Estimates suggest that we will need between 6 and 16 gigatonnes of removals annually by mid-century; yet, the market today delivers only a fraction of that capacity. Bridging this gap requires urgent investment and deployment now.

Why is CDR an essential, near-term, climate solution?

Decarbonisation, or the reduction and eventual elimination of fossil-fuel-based emissions, is essential to fighting climate change. The science is clear—reductions alone cannot deliver a 1.5°C future. To some degree, on the order of a few to ten billion tonnes each year, negative emission technologies will be necessary to bring climate mitigation back on track and reach a final state of net zero. CDR directly addresses both historical and residual emissions: those already in the atmosphere and those that are extremely difficult or costly to reduce in sectors like heavy industry. Governments, companies, and organisations of all types must take ambitious action to reduce and remove in tandem.

Most net zero frameworks have treated CDR as a final-stage activity, reserved for hard-to-abate emissions closer to 2050. Delayed CDR deployment is ill-advised for climate mitigation and overlooks its immediate value. Scaling removals today achieves three things:

- Climate imperative: The pace of warming is accelerating, and mitigation pathways already assume large volumes of removals. Deploying CDR now helps close the gap between current trajectories and the 1.5°C goal.

- Lower long-term costs: Early investment sends market signals. By growing supply chains, infrastructure, and financing mechanisms today, we avoid the cost spikes that would come from a last-minute scramble in the 2040s.

- Climate credibility: Companies and governments are under pressure to deliver on climate promises. Integrating CDR now strengthens the credibility of net-zero pathways, backing ambitions with action.

We'll dive into each pillar below.

Why we can't wait: the climate imperative

CDR can close the near-term emissions gap and help address ongoing emissions. The 'emissions gap' is a term that notes the disparity between climate pledges and actual emissions levels. While emissions rise, the ambition and actual implementation of net-zero strategies lag. Paris Agreement signatories need to cut an astounding 42% of emissions by 2030 to get back on track with 1.5°C.

Deploying the entire suite of CDR pathways can play a significant role in helping to close this gap and get back on track with net-zero goals before it's too late.

Investing today lowers long-term costs.

Like renewable energy, the cost of CDR will fall as deployment scales. Projects today receive investment from diverse sources, primarily credit sales in the voluntary carbon market (VCM). Early demand signals, even from smaller investments today, contribute to broader market-building and boost trust in the viability of the CDR ecosystem. Building long-term offtake agreements now also de-risks technology growth and signals seriousness to stakeholders.

These are important mechanisms to help projects secure pre-finance, covering costs of operations and ultimately lowering the long-term purchasing price. On the individual buyer level, companies that commit early can secure access to scarce supply at predictable prices, rather than facing inflated costs in the 2040s. And those that price emissions today are more likely to decarbonise faster, saving money in the long-run.

Upholding climate credibility

In an era of widespread net-zero targets, stated climate ambitions often differ from expected or actual implementation. With climate credibility in question, organisations can leverage CDR to take responsibility for any ongoing emissions and offer tangible proof that their goals are more than hot air.

Stakeholders, from regulators to customers, want proof that pledges translate into measurable action. Companies that incorporate removals today demonstrate leadership, safeguard their brand reputation, and build trust by showing they are not waiting until the last minute.

Aligning internally to take action now

It is essential to build a strong internal business case for immediate CDR engagement. The strategic opportunity for CDR today lies in anticipating future risks and fostering genuine climate leadership. Here's why:

- Manage future risks. Supply is scarce today and will only continue to crunch as the thousands of net-zero target setters approach their target years and need to purchase offsets.

- Get in line with upcoming regulations. Whether voluntary or codified, climate legislation is around the corner, and ESG agendas are here to stay.

- Social license to operate. Taking action today boosts brand reputation and trust. Climate leadership is essential for stakeholder and employee satisfaction, and can even impact a company's valuation.

How we stay on track for our common climate goals

The role of CDR in 2030 is about scaling up: proving pathways, establishing standards, and building the infrastructure that enables exponential growth. By 2050, it must be delivering gigatonnes annually. That trajectory cannot be achieved without today's corporate and policy leadership.

For companies, the question is no longer whether to include removals, but when to do so. Early movers will secure lower costs, influence market design, and establish climate credibility. Governments, investors, and corporations all share responsibility, but businesses in particular have the chance to shape the market through procurement, partnerships, and long-term commitments. Net zero is not possible without CDR—and the time to scale it is now.

How intermediaries drive growth for essential carbon removal pathways.

How can we manage costs while developing diverse removal solutions?

Emerging solutions are essential for a diversified and resilient CDR portfolio. There is no single 'silver bullet' method for carbon removal – each has its own capabilities and limitations that factor into its scaling potential. We must pursue a suite of pathways to fight climate change, including emerging solutions. However, these are often nascent technologies, operating within a broader supporting ecosystem that is still under development. This is evident in the limited pool of entities capable of executing third-party validation and verification audits, as well as the implementation of measuring, reporting, and verification (MRV) systems. While improving quickly, these factors can hinder the roll-out of a project or technology.

It's a real chicken-and-egg problem: early-stage solutions need funding to mature, but high price and limited supporting infrastructure make widespread investment seem both costly and risky. On the other hand, organisations with net-zero targets know they need to purchase diversified CDR to reach net zero, but can pause due to these barriers. As a result, many projects struggle to secure off-takes or investment due to their early-stage status and high price per tonne.

The power of aggregation and intermediation: how 'regular' companies can help scale the market.

While tech giants or large banks can financially support record-breaking CDR purchases on their own and even handle their due diligence and contracting, most companies need alternative approaches. Most entities understand best practices when it comes to carbon removal in Net Zero strategies, but they need support in mitigating price of credits, understanding the broader market complexity, and engaging meaningfully with suppliers.

By working with clients over long-term, multi-year commitments, we can support stronger planning for individual clients. At the same time, we also aggregate their demand with that of other clients, creating a buyer pool to take advantage of particular market opportunities that arise from our dialogue with key project partners, such as InPlanet. This coordinated approach enables us to provide greater certainty to projects and then pass that value back to our clients through risk-mitigated contracting approaches.

For sustainability teams and leads managing complex decarbonisation strategies among many other objectives, procuring a diversified and cost-effective CDR portfolio alone is simply not feasible. Klimate simplifies this process. We help clients build balanced portfolios of vetted projects while selectively providing pre-financing to suppliers, reducing a project’s costs per tonne. Through bulk purchasing, we create direct savings for clients while fostering both a more supportive ecosystem for CDR innovation and price reduction.

A case study in Klimate InPlanet Partnership: innovative Financing & Structuring

Our collaboration with best-in-class carbon removal projects enables us to demonstrate year-on-year how innovative financing structures facilitate scaling. One notable example is our partners at InPlanet, a project developer specializing in Enhanced Rock Weathering (ERW).

Enhanced rock weathering, in general, faces several challenges, including:

- High baseline price per ton, especially for near-term credits.

- MRV and certification infrastructure are still in the process of maturing.

- Low availability of spot credits excludes ERW from many "same year" credit portfolios.

Still, ERW is a highly permanent and scalable solution, with broader co-benefits — an essential piece of the climate toolkit.

InPlanet, in particular, is a key leader in the ERW category, with an emphasis on tangible co-benefits for local farmers, high project transparency, and, importantly, certified MRV standards via Isometric. Their approach reinforces trust and integrity in ERW as a carbon removal method.

By aggregating demand from clients with forward-looking net-zero strategies, Klimate can sign multi-year agreements with InPlanet with later delivery timelines, looking forward to 2030. And, pre-financing helps cover the gap between some of the upfront operational costs and the ensuing sequestration timeline, inherent to ERW. The equation of later delivery plus pre-financing results in a lower purchasing price per tonne, lowering barriers to entry and thus strengthening the incentive to act now.

.webp)

Why does this financing structure matter to a CDR buyer?

Many companies seek to meet net-zero and SBTi targets by 2030. When purchasing CDR, these goals align with the later delivery timeline of our multi-year commitments. Buyers benefit from a balanced portfolio of carbon removal solutions, featuring both short-term and long-term deliveries while mitigating risk and achieving annual targets in the short term.

That InPlanet has already successfully issued third-party certified credits via Isometric adds to the credibility of the project and also instills confidence that clients can utilise these credits with confidence for neutralisation purposes in their strategy.

How we sustainably scale the market.

When Klimate aggregates demand across various clients, we also identify the right opportunities that strike a balance between risk and benefits. These could be a combination of different delivery timelines, project or technology preferences, voluntary or mandatory frameworks, risk appetites, or connections to broader sustainability objectives.

Mitigating risk across diversified pathways and project developers can also help build confidence across the market, as portfolios and client investments are more stable and secure. One project or pathway that underdelivers or struggles will not mean the entire market suffers. It benefits market health as a whole and allows for prioritising different pathways for different purposes. This is particularly apparent across permanence and delivery timelines, allowing companies to depend on more mature technologies for short-term deliveries while still supporting the growth of others in the long term.

A model that meets the mission

Klimate's model unlocks long-term viability for enhanced weathering, contributing to our mission of accelerating and developing essential pathways while also bringing tangible impacts to the climate and communities. InPlanet has already demonstrated project-level success and has particular credibility from its previous successful issuance of certified credits via Isometric. Partnering with projects like InPlanet enables our clients to benefit from strategic alignment, cost savings, and progress towards decarbonisation. And this growing support signals a mature, scalable pathway for permanent carbon removal — essential for achieving net zero.

Klimate’s Carbon Asset Manager (CAM): the portfolio software for a tech-enabled net zero.

A new category of software.

Companies rely on software when business needs to outgrow a simple Excel sheet. Since our inception, we’ve helped companies access vetted carbon removal credits, create diversified investment portfolios, and strategise procurement to meet any goal. Carbon removal strategy has moved beyond a transactional, one-time purchase. Our carbon portfolio manager eliminates the manual labour and potential errors of multiple sheets while setting climate leaders up for what’s coming.

Why sustainability professionals need The CAM.

Sustainability professionals are pressed for time and budget to manage all the moving pieces of a good net zero strategy. Between balancing progress on overarching decarbonisation targets, procuring renewables, and making purchases from multiple vendors, meeting targets is already tricky. Moreover, companies that want to invest in a diversified portfolio face increasingly complicated procurement, management, and reporting for their carbon credits to comply with voluntary or regulatory standards. Bottom line: A solid net-zero strategy with carbon removal credits creates significant administrative challenges for companies, including the need for endless spreadsheets, coordination with individual registries, and manual retirement.

Without a proper tool to centralise data, information quickly becomes fragmented and prone to error. Even businesses just getting started in procuring carbon credits face multiple, manual integrations, creating extra administrative work and room for error.

We’re entering a new era of carbon compliance where the need for removals and the complexity that comes with it creates massive challenges for corporates working toward net zero. Spreadsheets may be the origin of all software. But companies must consolidate their data if they want a real chance at achieving their targets efficiently and without creating unnecessary, avoidable risks. We’re equipping sustainability teams with a critical net zero tool before they’re forced to have it, helping them stay ahead of coming requirements and build confidence in their strategies today.

-Erik Wihlborg, CCO

How can The CAM simplify your carbon removal strategy?

With growing activity comes growing scrutiny. The last financial year alone has brought several regulatory changes, i.e., EU Green Claims, CSRD, multiple EU-state CDR policies, and an updated SBTi Net Zero Standard. To stay ahead of changing regulations and the rapidly evolving carbon market, we’re unveiling a new portfolio manager called The CAM. This portfolio manager is built with climate leaders in mind. Klimate’s portfolio management software allows you to centralise all your credit data from different sources, track goal status, and confidently report on your accomplishments.

- Centralise data to avoid unnecessary error: Instead of managing multiple sheets, import all credit purchases to one source with automated overviews in your personalised dashboard. Save time (and stress) of procurement by accessing vetted projects, data from a 301 point due diligence, and consolidate all your carbon credit purchases–even across vendors.

- Flexible asset grouping for changing targets: Was Scope 2 higher in 2024 than anticipated? No problem. Organise your credits to reflect any strategy and simply re-allocate to keep yourself on track. Monitor your progress even with changing goalposts, integrate with multiple registries, and retire all assets with a single click to make meeting your target clear and simple.

- Confidently report on your progress: Whether voluntary or compliance-based, transparent and auditable communications are critical to protect your brand from greenwashing. Our modular reporting tool and single-click export enable you to report and comply with any modern requirement from CSRD, SBTi, and other relevant frameworks. Access communication guidance, project metrics, and visual content to make your investment tangible for your audience.

Tech infrastructure is crucial for market growth.

Carbon removal is growing and evolving rapidly. An essential piece of net zero, the current supply trajectory still isn’t efficient enough to reach these global goals alongside ambitious reductions. Today’s projections call for upwards of 10 gigatonnes of carbon removed year-on-year by 2050. This demands a massive degree of public and private effort to contribute enough resources, especially financial. We need to collectively invest in the order of millions or even billions of dollars to achieve net zero. In addition to sustainable, justly scaled land use and resource allocation for this massive physical undertaking, we need the right digital infrastructure to scale efficiently and securely. For companies and organisations with net zero targets, doing their part of global net zero must build dynamic strategies and streamlining of once-complicated procurement efforts, backed by digital assurance like The CAM, to be successful.

BVCM & SBTi: an essential strategy to address ongoing emissions

What is a BVCM strategy & how does it contribute to climate mitigation?

In a BVCM strategy, companies provide finance for scalable solutions, including activities that avoid, reduce, or remove GHGs but do not count as reductions in a company’s emissions inventory. These activities can range from high-integrity natural or technical removal credits, financing of permanent reductions, or conservation on natural carbon sinks. Beyond broader climate goals, these strategies enable companies to take responsibility in the near term, as advised by corporate target setting standards such as SBTi’s recent Corporate Net Zero Standard.

Integrated into the world of CO2 credits, a BVCM pledge may look closer to a contribution strategy, compared below:

- Compensation: a strategy in which carbon credits offset specific emissions in a company’s value chain (e.g., addressing residual emissions in Net Zero goals).

- Contribution: a strategy where corporations purchase units to support the development of essential solutions. This allows them to take meaningful action on their ongoing emissions, even though these activities do not directly reduce or offset their own Scope 1, 2, or 3 emissions.

Overall, BVCM helps close the gap between ambitions and actual implementation, catalyses immediate mitigation, and accelerates global climate efforts by securing finance for emerging solutions. Without additional financing of mitigation measures today, climate action lags–risking even a 2°C target. In the long-term, solutions including technologies or natural ecosystems that enable permanent reductions and removals may lack the necessary gigatonne scale for a 2050 net zero deadline.

For further reading on creating and implementing a BVCM pledge: https://www.klimate.co/insight/science-based-targets-releases-guidance-on-beyond-value-chain-mitigation

Who engages with BVCM and why?

Organisations with net-zero targets and those seeking to take immediate responsibility for emissions beyond their value chains are the primary groups engaging with BVCM. Companies engage with BVCM for several reasons:

- Urgency of climate action: BVCM allows companies to act on ongoing emissions even when direct reductions are not yet possible.

- Demonstrating climate leadership: For net-zero target setters and early adopters of climate strategies, BVCM provides a strategic way to show commitment to long-term emissions reductions.

- Credibility and responsibility: Organisations want to take responsibility for their ongoing emissions, building credibility in their climate actions.

- Mitigating greenwashing risks: Separating contribution strategies from core emissions inventories enables clearer reporting and more credible climate commitments.

- Scalability of solutions: BVCM offers a flexible approach, making it suitable for both organisations just starting their climate journey and those with ambitious, long-term sustainability goals.

For many, the tangible benefits of contribution strategies are already becoming clear, reinforcing BVCM as a critical element of a comprehensive corporate climate strategy.

”Our customers are striving to reduce emissions within the value chain. In addition to that, they also make an effort to remove emissions outside their value chain as a supplement to the reduction journey. Because we work with afforestation, which is both a measurable AND noticeable climate action, the investment is not only tied to the sustainability or finance department, but also often in HR, Marketing and Sales.” says Poul Erik Lauridsen, CEO Klimaskovfonden

Still, clear incentives and mechanisms for a wide-spread BVCM adoption are needed now. To this end, SBTi’s latest guidance may address adoption delays by providing clear instructions and recognition for organisations going above and beyond with BVCM.

Case Study: national climate commitments and local benefits in Denmark

BVCM strategies align with broader climate goals by supporting local afforestation projects in Denmark. With the Danish government aiming to plant 250k hectares of forest by 2045, companies can contribute to national climate commitments while enhancing local ecosystems. Klimaskovfonden’s tree planting projects offer tangible benefits, from carbon storage to improved biodiversity and water quality, making them a prime example of a high-quality BVCM project.

Supported by science-based frameworks like SBTi and Gold Standard, these initiatives show how BVCM can drive both global and local impact.

How will SBTi incentivise widespread adoption of BVCM?

Negative emissions pathways are increasingly central to corporate climate strategies, and SBTi’s latest guidance reinforces this by highlighting the need for removals, alongside other near-term mitigation actions, to ensure the 'net' in net zero. The guidance urges companies to act now to integrate removals into their near- and long-term strategies, in particular through use of Scope 1 neutralisation and beyond value chain mitigation.

This draft standard clarifies multiple aspects regarding corporate near-term action:

- This draft acknowledges the urgency of addressing emissions released into the atmosphere today and the critical role that companies can play in mobilising finance for mitigation activities beyond their value chain.

- Since ongoing emissions are a primary driver of negative climate impact, it is crucial for companies’ credibility to take responsibility for them.

- The SBTi aims to incentivise companies to take responsibility for the impact of ongoing emissions by providing optional recognition for these actions.

This degree of recognition has the potential to create wide-spread BVCM adoption from both SBTi target-setters and beyond by standardising science-backed best practices for investment. With this increased visibility of contribution actions and products, we anticipate that contribution products will increasingly gain a footing and recognition in the voluntary CO2 market in the coming years.

Still, without broader requirements for BVCM or removals across all industries, demand generation could stall. This could work against the noted ambition gap recognised by the scientific community. The question remains if companies are both knowledgeable of the need and ready to act, otherwise the demand levers of a ‘gold star system’ to recognise leadership may not be strong enough. To combat this, a stronger clarification of the link between BVCM strategies and corporate responsibility is essential from frameworks such as SBTi.

Driving value through climate action.

As further climate regulations change, BVCM will become increasingly relevant in demonstrating commitment to real, impactful climate mitigation while mitigating greenwashing risk. Already today, contribution approaches that follow leading frameworks remain popular to boost company reputation and climate leadership.

The characteristics of a strategic contribution strategy include:

- Support scaling of both nature-based and engineered carbon removal solutions with synergies across biodiversity and local communities.

- Provide flexible investment opportunities outside the direct scope of emissions, broadening the scope of corporate engagement.

- Separate reporting inventories of overall decarbonisation and other financial contributions allow clear communication of progress with key stakeholders and audiences.

The growing importance of BVCM in bridging the climate action gap is made clear by it’s rise in climate reporting frameworks such as SBTi. This strategy unlocks massive potential for companies to drive both immediate and long-term mitigation outcomes through strategic BVCM investments–and speed up action even while other levers may slow down. One thing is certain–deploying climate finance to help reach our broader goals is possible today and an essential element of corporate climate action.

SBTi’s Revised Net-Zero Standard: What It Means for Carbon Removal

A Step Forward for Carbon Removal

One of the most notable updates is that the new draft includes explicit near-term targets for removals, reinforcing that CDR should not be a last-minute fix, but rather an integral part of corporate net-zero strategies. Under the proposed framework, companies must start investing in removals well before their net-zero target year, setting interim milestones to ensure alignment with long-term climate goals. This shift could provide much-needed investment certainty for carbon removal projects and developers, helping to move the industry beyond its current reliance on voluntary early adopters.

Additionally, the revised standard affirms that once a company has reduced its emissions as much as possible, it must neutralise residual emissions with high-durability carbon removal. This is a positive development, as it strengthens the case for scaling durable removal solutions such as biochar and direct air capture (DAC).

Limiting the Scope of Removals: A Missed Opportunity?

Despite these positive steps, the revised draft restricts the use of removals to Scope 1 emissions, at least until companies reach their net-zero target date. Scope 2 and Scope 3 emissions are not currently required to be neutralised with CDR until the long-term phase. For many companies that do not produce their own goods, Scope 3 emissions account for 70-90% of a company’s total emissions.

This decision has sparked debate among climate experts and CDR advocates, highlighting several key concerns:

- Without widespread requirements for CDR integration, this dampens the demand for near-term carbon removal credits and presents a challenge to scaling the market in time for net zero. Without widespread investment today, supply wont be ready for the amount required in the future.

- By limiting near-term CDR requirements to Scope 1, SBTi risks delayed integration of removals from some of the most ambitious corporate net-zero leaders. Many industries with high Scope 1 emissions such as heavy industry and aviation have been slow to adopt SBTi targets, whereas sectors with predominantly Scope 3 emissions (e.g., consumer goods, finance, and tech) have been more proactive. Fewer companies are then incentivised to invest in removals, especially those with ability to pay.

- Omission of Beyond Value Chain Mitigation (BVCM) in SBTi’s required near-term targets could further limit demand. Companies are encouraged to invest in removals and other actions outside their value chain. But, there is no formal recognition of these actions, potentially dulling incentives despite growing interest in BVCM strategies. Stronger guidance on how removals can support Scope 3 abatement in the transition phase could help incentivise greater climate mitigation, drive demand, and accelerate the scale-up of much-needed CDR solutions.

SBTi’s suggestion to direct removals to Scope 1 emissions is founded on the idea that Scope 2 emissions will almost certainly be zero by target years, and Scope 3, at present, is too difficult to estimate at this time and raised concerns over double claiming. Is a Scope 1 requirement the most hopeful case for interim removal targets, or is another path possible?

The Risk of Delayed Corporate Action on Removals

Strong, consistent demand signals are critical to securing financing and scaling supply for CDR project developers. By postponing mandatory removals for most emissions until the net-zero target date, there is a risk that many projects will struggle to secure the off-takes they need to reach commercial viability. Investors and project developers need clear and sustained demand commitments today—not just in 2040 or 2050.

Furthermore, the current framework may encourage companies to delay engagement with removals altogether as the bulk of companies under SBTi commitments do not have a large Scope 1. As is pointed out in this analysis, while CDR demand will increase among companies that estimate having residual Scope 1 emissions at net-zero, it can potentially hamper the individual efforts within companies without large Scope 1 (which include most companies!).

If companies postpone action on CDR until their net-zero date is near, total demand goes down. Moreover, expected cost reductions for high-durability removals would also be delayed, making it even harder to achieve affordability at scale. This is a major concern given the IPCC’s projections that we will need to scale CDR to several giga-tonnes per year by mid-century to stay within 1.5°C.

Where Do We Go from Here?

SBTi’s revision is still in draft form, and stakeholders now have the opportunity to provide feedback during the public consultation period. While the inclusion of near-term CDR targets is an important step, the framework must strengthen corporate incentives to invest in high-quality removals earlier in their transition pathways to build the necessary infrastructure for long-term scalability.

To ensure that removals play a meaningful role in corporate climate strategies before the net-zero deadline, potential revisions could include allowing (or even requiring) removals for a portion of Scope 3 emissions in the near term, particularly for hard-to-abate sectors. In this scenario, companies with higher ability to pay could help fund scaling for permanent removals that make up their Scope 3, aiding the sectors that are less able to afford Scope 1 reductions. These areas are often where most residual Scope 1 emissions will be remaining at net-zero. This paper–which is worth reading–discusses just this topic, pointing out how “approximately 90% of emissions originate from companies that generate only 25% of profits, highlighting a disparity in the ability of polluters to pay the cost of their emissions and fund climate solutions, including carbon removal.”

The current proposal from SBTi does not take the above imbalance into account, meaning that it is likely that a large portion of Scope 1 emissions will not be neutralised at the net-zero target date unless incentives urge companies with higher ability to pay to neutralise those emissions. The imbalanc in profit per tonne emitted is displayed in the figure below, highlighting sectors with a high ability to pay across the GHG emission scopes.

Final Thoughts

The revised SBTi draft is a mix of progress and limitations for carbon removal. While it establishes a clearer role for CDR, its restricted application to Scope 1 emissions, and the mere encouragement of CDR within BVCM could slow near-term demand just when the market needs momentum.

Now is the time for corporate sustainability leaders, project developers, and climate experts to weigh in. If we want to see a thriving carbon removal market that supports a robust net-zero transition, we need guidelines that drive—not limit—demand.

What do you think? Does the new SBTi draft go far enough in supporting carbon removal? Should it require earlier adoption for Scope 3 emissions? We’d love to hear from you.

Benchmarking with the best

Science-led and data driven